Standing water does more damage to your house by the second — it’s time to act fast.

Every minute you leave standing water to infiltrate your house gives more time for drywalls to soak, mold to develop, and structural damage to appear. Homeowners need to take immediate action – but does home insurance cover water damage SOS cleaning and restoration?

Home insurance policies aren’t federally required – yet 88% of homeowners had one in 2023, according to the Insurance Information Institute. 22% of homeowners also reported they are at risk of flood damage, with 78% of those purchasing separate flood insurance.

The Northeastern states have the highest rates of flood insurance in the country. That’s because locations like Long Island are high-risk areas prone to storm surges and other severe weather events.

Between 1980 and 2024, the state of New York had 86 weather events with costs exceeding $1 billion each. Severe storms accounted for nearly half (48.8%) of the costs, data from the National Oceanic and Atmospheric Association showed.

But water damage doesn’t just result from extreme weather events. A burst pipe is far more likely to do the damage. One in ten houses in the US have plumbing leaks that waste at least 90 gallons of water per day, according to the Environmental Protection Agency.

Whether your house experiences a water leak or storm damage, immediate action from emergency services is needed to avoid extensive property damage. Worries about insurance claims can be postponed.

But does home insurance cover water damage SOS cleaning and restoration? In this article, we dive into the topic and explain:

- Which insurance policies cover water damage emergency services

- What types of water damage are covered by the different insurance policies

- How to get SOS cleaning and restation services to your doorstep in 60 minutes

Read on to find out if your home insurance covers water damage restoration.

[Water damage requires immediate response. Call Lux Restoration to have our emergency water remediation crew on your doorstep in 60 minutes.]

Which insurance policies cover water damage emergencies?

Not all home insurances are equal. Some cover just the basics while other insurance policies have all-risks coverage and add-ons. Here’s a brief overview of the types of insurance available for residential properties:

Types of homeowners insurance

| HO-1 | Limited policy that generally isn’t sold anymore |

| HO-2 | Policy for single-family homes with more perils covered |

| HO-3 | Most common single-family home policy with all-risk peril coverage |

| HO-4 | Policy specifically for tenants |

| HO-5 | Most comprehensive single-family home policy with higher coverage limits |

| HO-6 | Policy for condo owners (not the master policy under HOA’s responsibility) |

| HO-7 | Policy for mobile or manufactured homes |

| HO-8 | Policy for old properties with high rebuild cost and low market value |

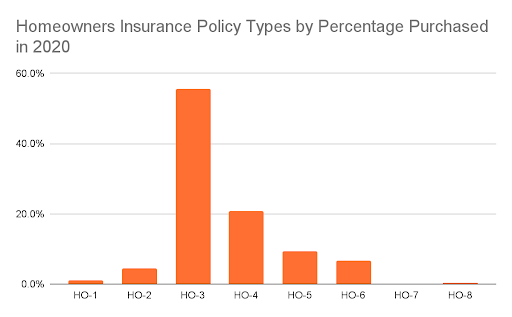

Most US homeowners have an HO-3 insurance policy, while the most comprehensive HO-5 accounts for less than 10% of purchased insurance policies in 2020.

Source: National Association of Insurance Commissioners

So does home insurance cover water damage SOS cleaning and restoration?

When it comes to insurance coverage, all policies from HO-2 upwards cover 16 perils ranging from fire damage to natural disasters. Of those perils, the following are water-related:

- Accidental discharge or overflow of water or steam

- Sudden and accidental tearing apart, cracking, burning, or bulging of a built-in appliance like a water heater, centralized air conditioner, or heating system

- Freezing

Other water-related perils are specifically excluded from coverage:

- Water damage from flooding, sewer backups, or water that seeps up from the ground

- Neglect

- Mold growth, fungus, or wet rot (except when resulting from accidental discharge or overflow of water)

- Discharge, dispersal, seepage of pollutants

Knowing this, does home insurance cover water damage SOS cleaning and restoration? Yes – depending on the cause of water damage, the insurance company may accept your claim.

For instance, flooding is not covered while water damage from a burst pipe is. Mold damage restoration is covered when resulting from an overflow of water – but is excluded otherwise.

Differences in HO-2 and HO-3 policy coverage

Both the HO-2 and HO-3 policies cover the physical structure at replacement cost value, while personal belongings are covered at actual cash value.

But while both homeowners policies have personal property coverage for the same perils, there are some notable differences between HO-2 and HO-3 insurance policies.

Most importantly, the HO-2 (also named a named perils policy) only covers your home and personal belongings against the 16 specific perils listed in the policy.

The HO-3 policy provides all-risks (or open peril) coverage that protects the structure of your home against all perils except the specific exclusions listed in the policy form. How does that work when filing an insurance claim, exactly?

The claims process works as follows. With an HO-2 policy, the onus is on you to prove that a named peril caused the damage.

Under an open perils policy, the onus lies with the insurance provider. A claims adjuster has to prove the damage is caused by an excluded peril. Insurance exclusions create better dwelling coverage by protecting your house from everything not specifically listed as an excluded cause of damage or loss.

What does an HO-5 homeowners insurance cover?

The HO-5 policy is the most comprehensive homeowners insurance policy available. This type of insurance has higher coverage limits for maximum reimbursement and is often used for high-value properties.

The HO-5 provides open peril coverage on both your home and personal property. In comparison, an HO-3 policy only provides open peril coverage on a dwelling and named peril coverage on personal property. It also reimburses personal property at replacement cost instead of actual cash value.

However, the HO-5 insurance policy does not cover water damage restoration for any of the causes excluded under the HO-3 policy. For additional water and mold remediation coverage, homeowners can use so-called insurance riders.

How to get additional water damage coverage

When your property is at risk of water damage not covered by your insurance policy, like flood damage, you can use add-ons to increase your protection. These insurance riders (or endorsements) broaden your homeowners insurance coverage in various ways.

Insurance riders can cover otherwise excluded perils. They can also increase the coverage limit of included protection – which helps when the extent of the damage pushes restoration costs beyond your policy’s limits.

These insurance riders give you additional water damage coverage:

- Water backup rider: You might have noticed that the standard policies mentioned don’t cover the mitigation costs of water damage caused by sewage backups and backed up gutters. Many insurance providers offer additional coverage for this type of water damage.

- Mold damage rider: While your standard insurance covers mold removal when caused by water damage included in the policy, most mold remediation is only covered up to a limited amount. A mold damage rider increases that limit.

- Flood insurance: Standard insurance doesn’t cover flood damage and most insurance providers don’t have add-ons that do. Instead, many insurance companies offer separate flood insurance through the National Flood Insurance Program.

Getting emergency services to your doorstep in Long Island

Does home insurance cover water damage SOS cleaning and restoration? That answer depends on your specific policy and the cause of the damage.

Homeowners insurance provides coverage for water damage incidents like burst pipes or appliance overflows, but excludes costly events like flooding, sewer backups, and gradual leaks unless you add supplementary riders.

Water damage is every homeowner‘s nightmare, with the potential for further damage increasing by the minute. That’s why immediate water extraction and professional restoration services are crucial to mitigate destruction and get your property back to normal as quickly as possible.

When facing a water emergency, turn to the trusted experts at Lux Restoration. We have the expertise to handle the entire restoration process from start to finish and with a short timeline – from rapid response within one hour to efficient water removal, structural drying, mold remediation, reconstruction, and more.

[Is water seeping into your home? Get in touch with us for immediate help. Lux is Long Island’s trusted water damage restoration service with 17+ years of experience in water damage, from fixing flooded basements to restoring storm-damaged roofs.]